Best Business Analysis Courses & Certificate [2024]

In the globally competitive world of the 21st century business decision-makers face unprecedented levels of risk and uncertainty – to survive and flourish in this challenging environment.

Organisations need the right tools with which to analyse problems and anticipate and manage the many opportunities and threats that may emerge.

Traditional forms of financial analysis and forecasting no longer meet these needs and the most progressive firms are using the power of financial models to help them analyse the challenge and take a more powerful approach to managing risk in their planning and forecasting.

This leading-edge Business Analysis, Modelling & Forecasting business analysis training seminar will focus on the business analysis and modelling skills that the modern professionals need to manage the risks and uncertainties in today’s challenging world, providing high-quality business support to the organisation’s key decision-makers.

This training course will highlight:

- The challenge of risk and uncertainty in modern business

- Principles of business planning and performance management

- How financial models can be used to improve business decision-making

- Practical skills in designing financial models using Excel

- The design of financial models for forecasting and decision-making

Objectives

This hands-on business Analysis, Modelling & Forecastingbusiness analysis training seminar has been designed to provide delegates with real practical skills to design and build financial models that will have highly relevant applications in their own organisations to assist in financial analysis, forecasting and business decision-making. This training seminar takes delegates through the key steps in Excel and makes best use of the built-in functions featured in this popular spreadsheet application.

At the end of this business analysis training seminar, you will learn to:

- Plan the design and functionality of financial models in Excel

- Use powerful functions built in to Excel for statistical and financial analysis

- Apply financial analysis techniques to improve investment decision-making

- Design and build financial models for forecasting sales, costs and profit

- Implement up to date techniques for managing risk and uncertainty

- Use financial models to assist in business decision-making

Training Methodology

This is a highly participative workshop style seminar focused on developing practical skills that delegates can apply in real life business situations on return to their own organisation.

Each module includes a thorough review of the relevant theory before focusing on life-like business case studies with which delegates can practice the design and construction of financial models, analysis tools and forecast applications in Excel, using laptops provided for this business analysis training seminar.

Organisational Impact

The organisation will benefit from the practical implementation of up to date techniques in business analysis, forecasting and financial modelling that can be applied to improve the quality and relevance of business decision-making in the context of modern levels of risk and uncertainty – specifically:

- An integrated approach to managing business risk and uncertainty

- The use of financial analysis tools improve business information and insights

- Application of financial model tools to add sensitivity analysis to decision-making

- Improved forecasting tools and performance management systems

- Better quality information as the basis for capital investment decisions

Personal Impact

Delegates will benefit from this hands-on workshop that has been designed to provide them with the essential theory of financial analysis, forecasting and financial decision-making whilst focusing heavily on building the practical skills to develop their own financial models in Excel. This business analysis training seminar on business Analysis, Modelling & Forecasting will greatly enhance their contribution to organizational performance and improve their career prospects by:

- Developing an awareness of the nature and management of risk and uncertainty

- Greater involvement in management planning and decision-making

- Improved knowledge of Excel and its most powerful financial functions

- Using powerful Excel financial modelling skills for forecasting and decision-making

- Applying up to date methods to planning and forecasting

- Understanding and applying investment decision-making techniques

Who Should Attend?

This business analysis training seminar is designed to provide useful insights and practical skills to professionals from a wide range of disciplines and industry sectors, but particularly those involved in planning, forecasting and investment decision-making in an age of risk and uncertainty.

This training seminar is suitable to a wide range of professionals but will greatly benefit:

- Finance Professionals

- Budgeting and Planning Managers

- Commercial Managers

- Divisional Managers

- Purchasing and Supply Chain Managers

- Project Managers

Seminar Outline

Tools to Meet the Challenges of the 21st Century

- The Nature and Challenge of Competitive Business

- Managing Risk and Uncertainty

- Business Planning and Performance Management

- Measuring the Key Drivers of Business Success

- Financial Models – What they are and how to use them most effectively

- Best Practice in Building Financial Models

- How to Get the Best Results using Excel

Building Models for Financial Statement and Ratio Analysis

- The Financial Analysis Tool kit

- Building a company Financial Database in Excel

- Excel Charting Basics

- Analysing the Cost-Volume-Profit relationship

- Understanding the Drivers of Shareholder Value

- Modelling and Interpreting Financial Rations

- Using the Model to Improve Business Performance

Building Forecasting Models

- Understanding the Drivers of Profit and Cash Flow

- Designing and Building a Cash Flow Forecast Model

- Using Excel’s Built-in Data Analysis Tools

- Analysing Trends in Past Data – moving averages and regression tools

- Designing and Building a Sales Forecast Model

- Designing and Building a Cost Forecast Model

- Avoiding Common Problems in Forecasting

Building Models for Capital Investment Decisions

- Principles of Capital Investment Decision-making

- Building a Model to Calculate Company Cost of Capital

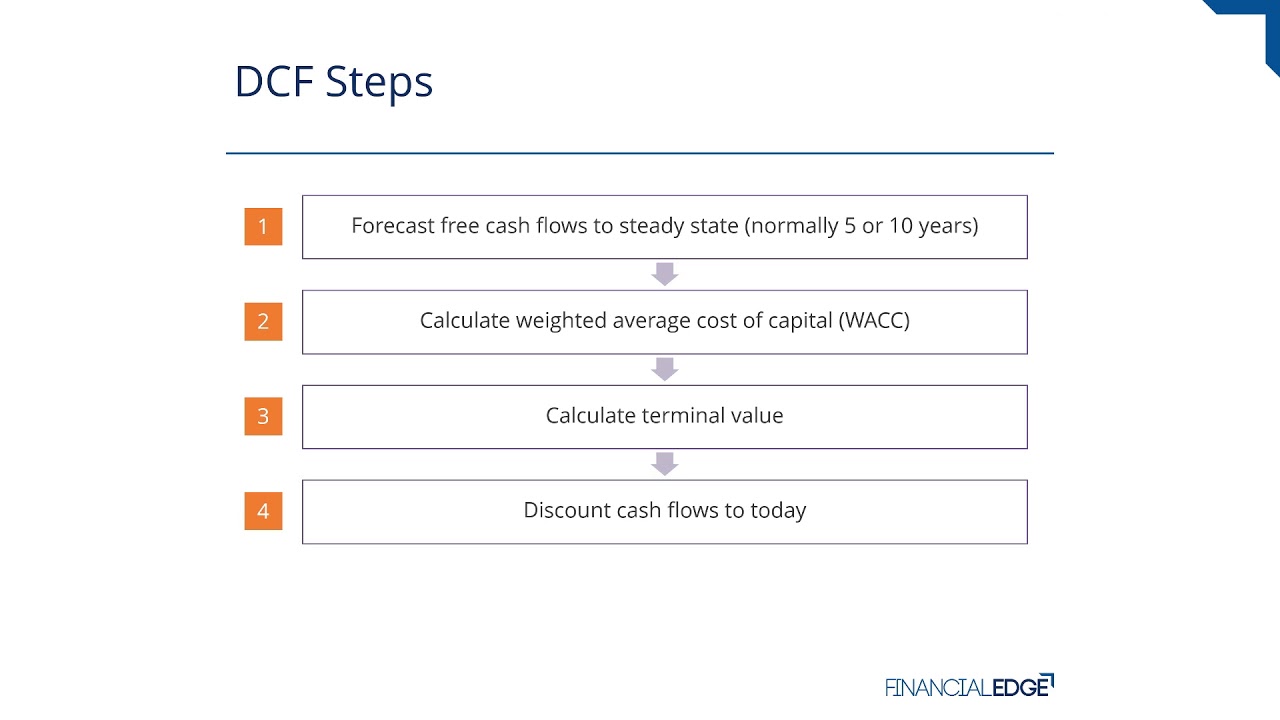

- The Time Value of Money and Principles of Discounted Cash Flow (DCF)

- Understanding and Using Excel’s Built-in DCF Functions

- Designing and Building a Capital Investment Appraisal Model

- Principles of Business Valuation

- Designing and Building a Business Valuation Model

Building Models for Managing Risk and Uncertainty

- The Impact of Risk on Financial Performance

- Identifying the Key Drivers of Financial Performance and Strength

- “What if” Forecasts and How They Work

- Designing and Building a Financial Statement Forecasting Model

- How to Use Excel Goal Seek Tool

- Using Excel’s Scenario Manager Tool

- Building Rolling Forecast Models in Excel

International Certificates from American Certification Institute, Delaware U.S.A (Including REMOIK Training and Consulting, West Africa) will be awarded each participant

Download our 2024 Training Calendar

Course format

Practical:

This course is heavy on reality and light on theory. Our trainers will introduce the concepts clearly, and then focus on real-world skills that connect the big picture to your job. Courses are updated regularly and trainers are active in the industry so employee’s knowledge will be fresh and relevant.

Active:

Training consists of concise briefings on best practice, backed up by interactive learning activities like workshops, role-plays, case study analysis, coaching, brainstorms and structured group discussions. Participants will not sit passively through long lectures.

Stimulating:

This course is interesting, intellectually stimulating and delivered in a relaxed and professional style.

Inspiring:

All REMOIK Pinnacle trainers are hands-on communication professionals with years of experience. We don’t employ academic teachers – we insist on good-humored enthusiasts who will inspire your creativity.

Business Analysis Training Methodology

- Lectures

- Discussions

- Individual and group exercises

- Case studies

- Activities

- Post- Course

- Assessments

- Pre-Course Assessments

- Games and educational competitions

- Professional videos & Audio presentations